File Corporate Transparency Act 2025. Effective january 1, 2025, most new and existing corporate entities in the. Singlefile is riding tailwinds from new regulations such as the recently implemented corporate transparency act (cta), which requires more than 30 million small business.

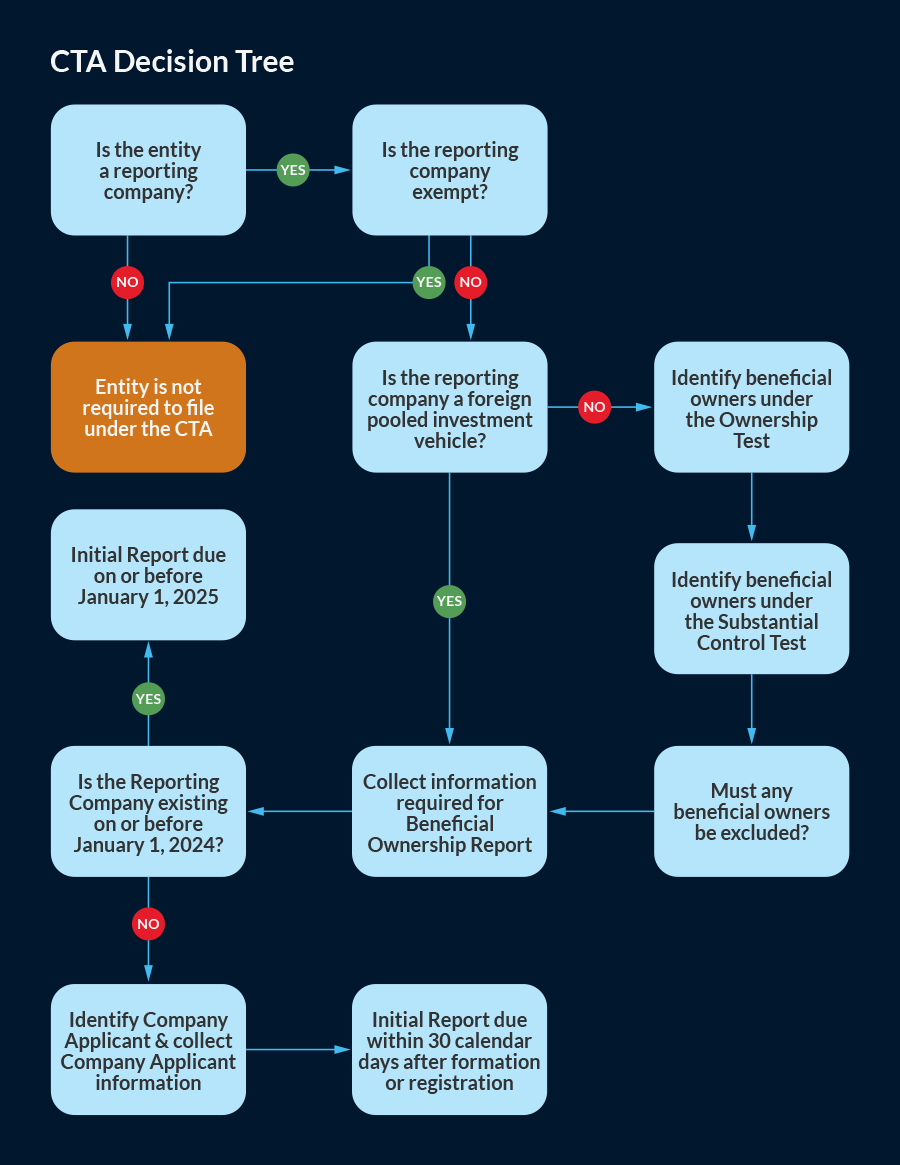

Today, the financial crimes enforcement network (fincen) issued a final rule implementing the bipartisan corporate transparency act’s (cta) beneficial ownership. The corporate transparency act requires certain business entities to report their beneficial owners, or those who own or have control of a company.

The cta aims to combat illicit financial activity and enhance national security interests by requiring certain.

New LLC Law 2025 Reporting Requirements ZenBusiness Inc., Here are four steps you can take to. An expert q&a on the corporate transparency act (cta), which became effective on january 1, 2025, discussing how businesses can meet their reporting obligations,.

Corporate Transparency Act Understanding Reporting Requirements, Proposed regulations issued on september 27, 2025, extend the period for which reporting companies formed on or after january 1, 2025, and before january 1, 2025, must. On january 1, 2025, the corporate transparency act (cta) went into effect.

Corporate Transparency Act (CTA) Effective January 1, 2025 YouTube, How to file your corporate transparency report. Fortunately, fincen recently pushed back the effective date.

Understanding the Corporate Transparency Act and Its Implications CCA, January 01, 2025 existing companies have one year to file; The cta aims to combat illicit financial activity and enhance national security interests by requiring certain.

Corporate Transparency Act What You Need to File and When, By now, cpas should be aware of the corporate transparency act (cta), passed in 2025 and effective january 1, 2025. //boiefiling.fincen.gov) on january 1, 2025.

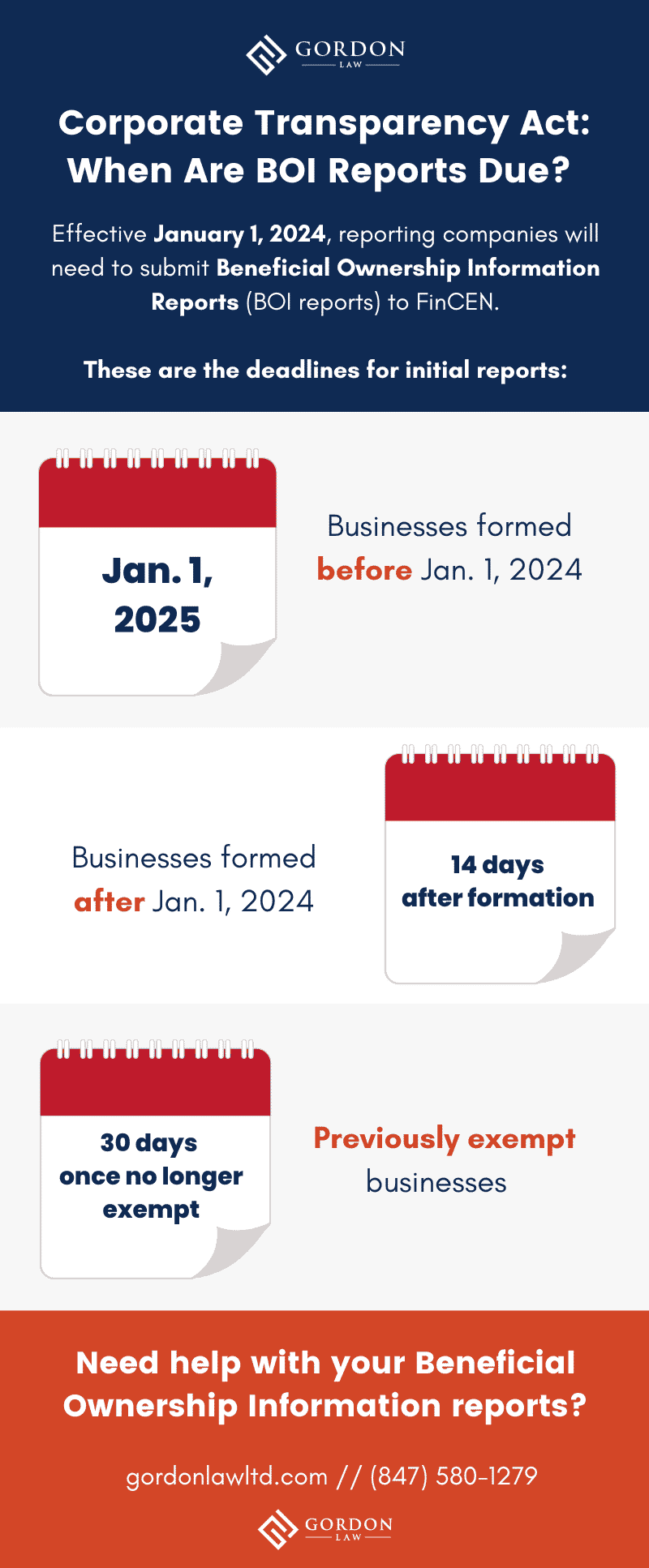

Corporate Transparency Act What Does It Mean for Business Owners, No fees are required to file a report. • a reporting company created or registered to do business before january 1, 2025, will have until january.

Corporate Transparency Act is Here What You Need to Know, Newly formed companies must report within 90 days after their existence becomes official. Fortunately, fincen recently pushed back the effective date.

Corporate Transparency Act What You Need to File and When, The corporate transparency act (cta), which went into effect january 1, 2025, will have an impact on trusts. March 1, 2025 by jonathan a.

Corporate Transparency Act What Every Business Needs to Know Prior to, By now, cpas should be aware of the corporate transparency act (cta), passed in 2025 and effective january 1, 2025. • a reporting company created or registered to do business before january 1, 2025, will have until january.

The Corporate Transparency Act and Beneficial Ownership Reporting, As of january 1, 2025, fincen has begun accepting beneficial ownership information reports. Here's what small businesses need to know to.

Singlefile is riding tailwinds from new regulations such as the recently implemented corporate transparency act (cta), which requires more than 30 million small business.